The Complete Trading Programme

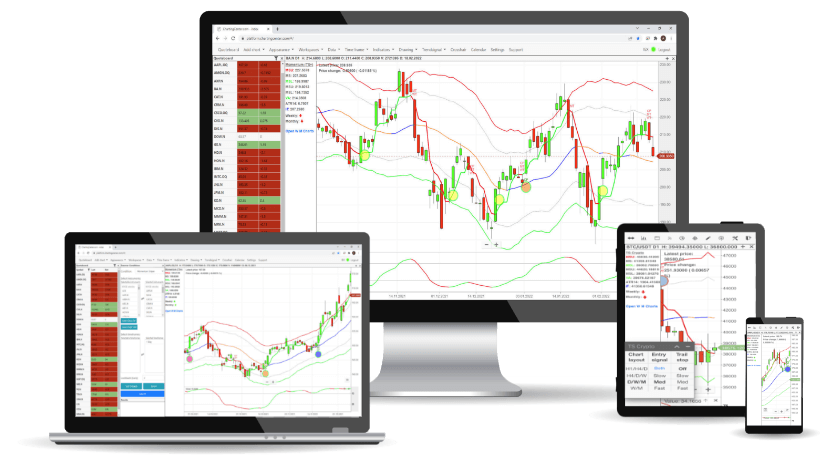

At Trendsignal, we give traders everything they need - a simple, rules-based trading system, 1-to-1 coaching, live weekly workshops, and full support to help you trade with confidence.

At Trendsignal, we give traders everything they need - a simple, rules-based trading system, 1-to-1 coaching, live weekly workshops, and full support to help you trade with confidence.

Trendsignal is a UK-based leader in online trading education, proudly located in the heart of innovation at Cranfield University Technology Park. Since 2003, we’ve helped thousands of traders and investors develop a more disciplined, structured approach to the financial markets through our award-winning trading programmes.

Our trading courses combine proven strategies, intuitive trading tools, and personal coaching to give you a clear, rules-based framework for identifying opportunities and managing risk. Covering Forex, Stocks, and Cryptocurrency trading, our programmes are designed for both new and experienced traders who want to learn to trade online with confidence and consistency.

Whether you’re focused on day trading or swing trading, Trendsignal’s comprehensive trading mentorship and education programmes provide everything you need to trade smarter, achieve your goals, and stay in control of your decisions.

Join a Free Trading Session to see how Trendsignal can help you take the next step in your trading journey.

Most investors are only interested in the price of stocks moving up over the long term. They are missing out on the significant price movements that take place every day. Online trading gives access to leverage, more markets, low commissions, and the ability to profit from rising AND falling prices. With the right trading strategy, traders can have a more flexible and potentially lucrative way to achieve their income and capital growth goals, and we want to show you how you can do it too.

Our online trading courses break down the challenges that many traders face on their own - namely confusion over complex strategies, low confidence and fear. Whilst many courses teach discretionary strategies that are impossible to replicate, our team of data analysts and traders have produced verified trading strategies that are followed by the clear rules that we provide. The professional coaching, trade scanners and signals help you learn to trade by finding high quality setups by following clear rules, becoming a more confident trader.

Raghbir Aujla

Member since 2012

Gordon Hams

Member since 2010

Lisa Beaney

Member since 2015

Graham Barlow

Member since 2015

David Hughes

Member since 2015

Carlos Andre

Member since 2017

Chris Tate

Member since 2017

Michael Upton

Member since 2015

By providing a simple, rules based approach to trading with colour-coded indicators and strategies, our experienced team has taught thousands of people worldwide for nearly 20 years.