Contemplating the economic rollercoaster of 2023, traders prepare for the repercussions of escalating prices, stagnant incomes, and the undulating pattern of growth. The recent decline in inflation just before Christmas raises questions about what awaits the trading community in the pivotal election year of 2024.

Inflation Insights:

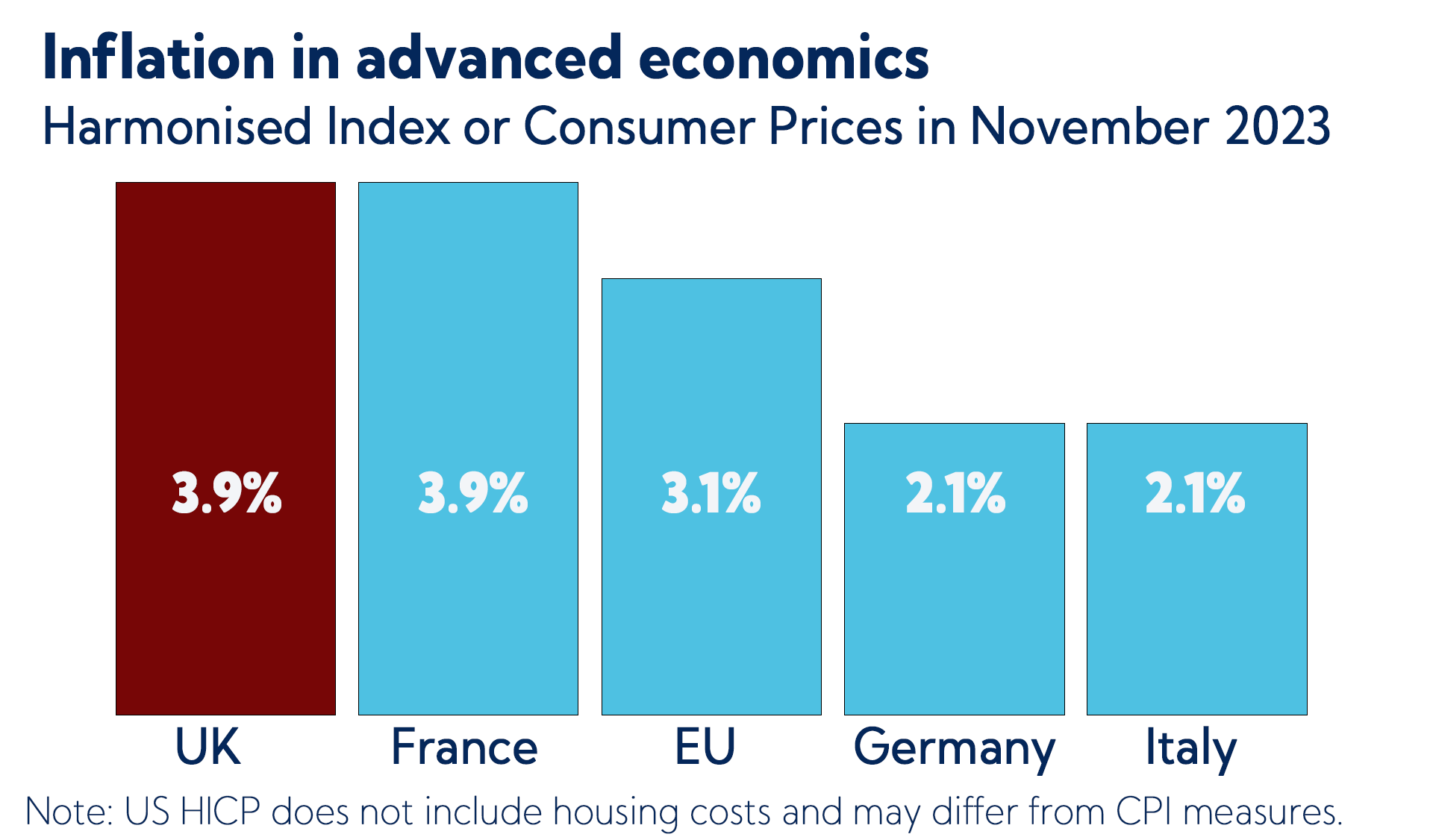

Although the most challenging phase of the cost-of-living crisis might be in the rearview, prices in the UK persist 3.9% higher than they were a year ago. A similar scenario unfolds in France, yet the UK's inflation continues to surpass both the EU average of 3.1% and that of the US.

Source: Eurostat, Office for National Statistics, Federal Reserve Bank

Interest Rates Outlook:

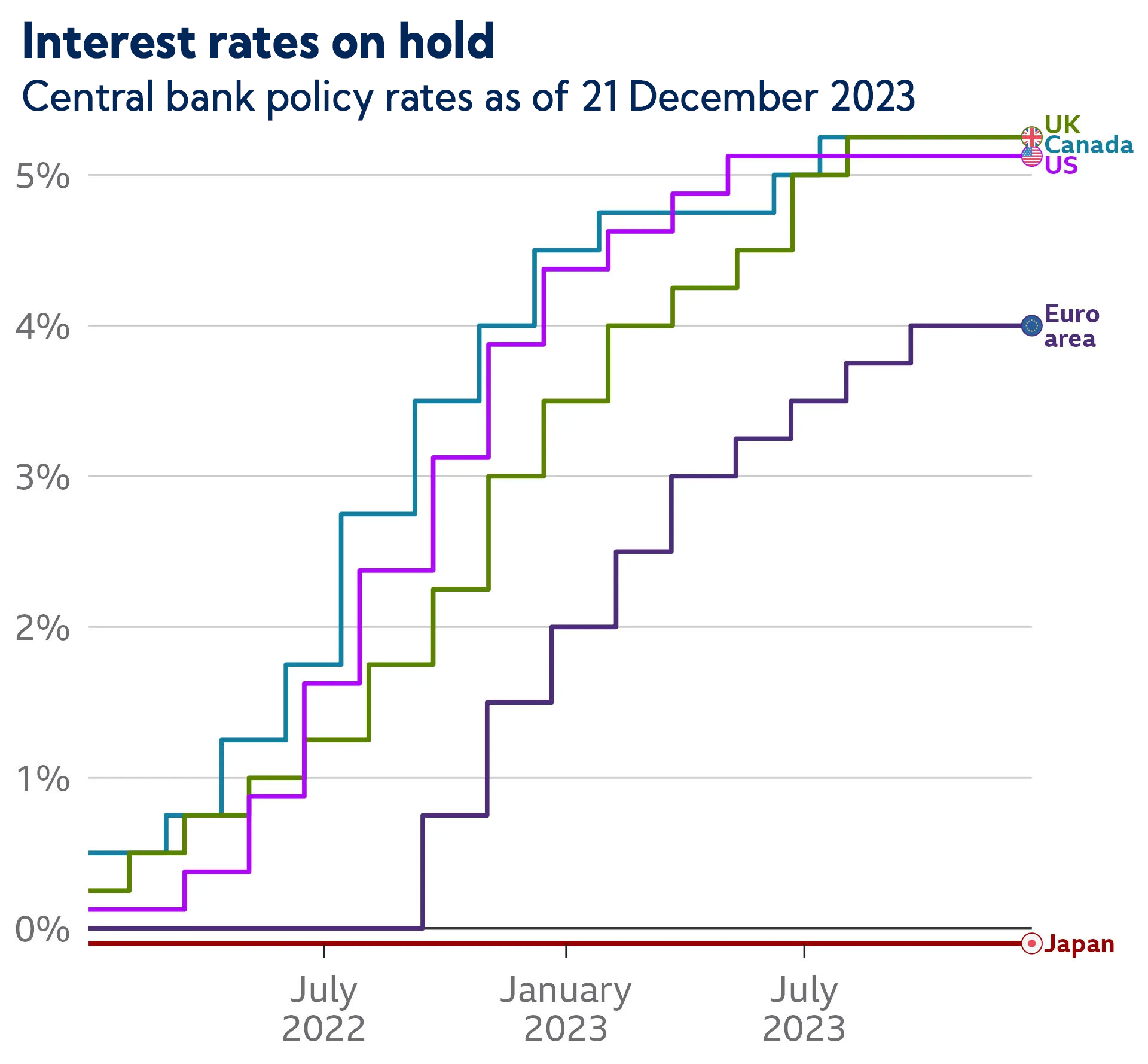

The enduring impact of the Bank of England's 14 rate hikes over the past two years is palpable. Traders, particularly those engaged in short-term fixed-rate deals, are experiencing the repercussions. Yet, a glimmer of hope surfaces—if the recent decline in UK inflation endures, a potential spring rate cut could be in the offing.

Source: National central banks

Growth Challenges:

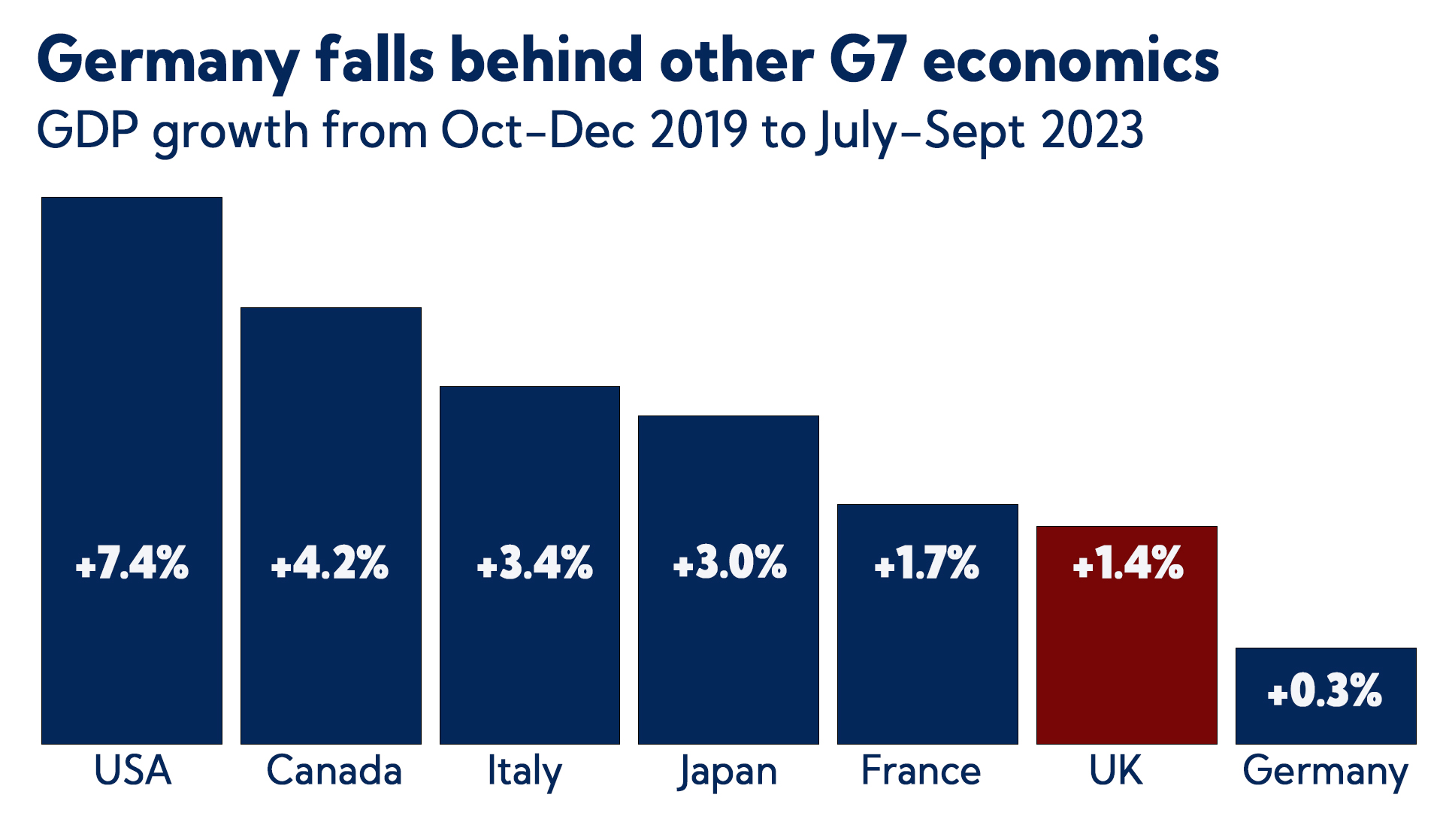

Despite an improvement over the initial estimates, economic growth is now grappling with recent stagnation. The effects of interest rates reverberating through incomes and spending have led the Bank of England to anticipate minimal growth in the coming years. The UK's growth trajectory, when compared to the pre-2008 financial crisis, prompts politicians of various affiliations to advocate for higher growth.

Source: OECD, ONS

Unemployment Dynamics:

In the face of challenges posed by the COVID-19 pandemic and successive rate hikes, the UK's job market has demonstrated resilience, aligning with the G7 average unemployment rate at 4.2%. Nevertheless, with the impact of rising interest rates, the specter of potential job losses looms. Policymakers view workforce reintegration as a pivotal factor for overall growth..

Taxing Times:

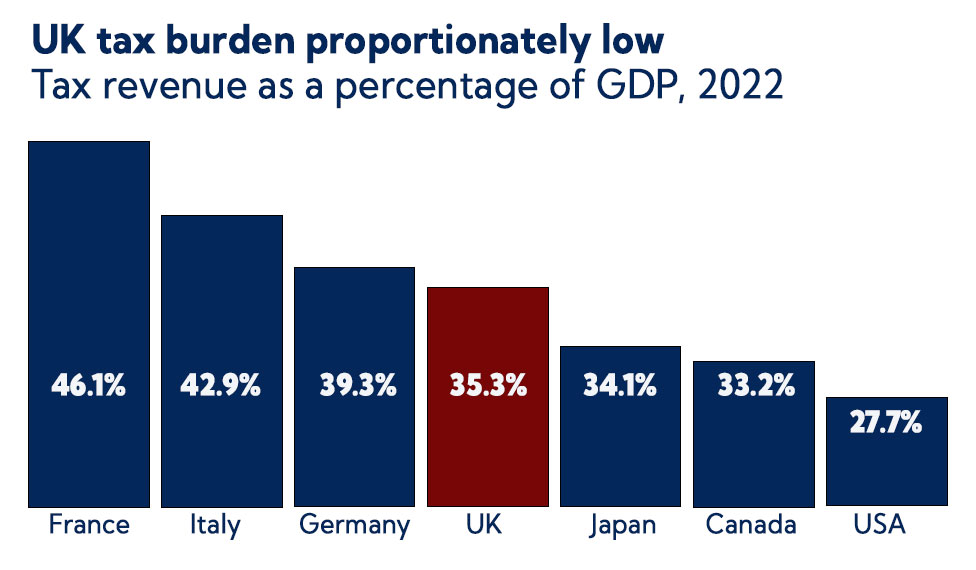

Apart from employment, inflation, and interest rates, tax burdens contribute significantly to shaping economic fortunes. While millions reap the benefits of a National Insurance cut, the emergence of rising tax bills indicates impending challenges. Despite being lower than the EU average, the UK's tax burden still establishes a post-war record.

Source: OECD

Global Perspectives:

As traders’ step into 2024, understanding the global economic context is key. While challenges persist, there are areas for optimism. The political and economic landscape becomes a crucial battleground, and Trendsignal stands ready to guide traders through these dynamic times.

As we navigate the uncertainties of the upcoming election year, arm yourself with insights from Trendsignal's in-depth analysis. From inflation nuances to interest rate forecasts, we've got you covered on all fronts.

Ready to enhance your trading strategies and boost your financial acumen?

Join our FREE Trading Webinar and gain valuable insights from industry experts. Seize the opportunity to refine your skills, ask questions, and connect with a community of like-minded traders.