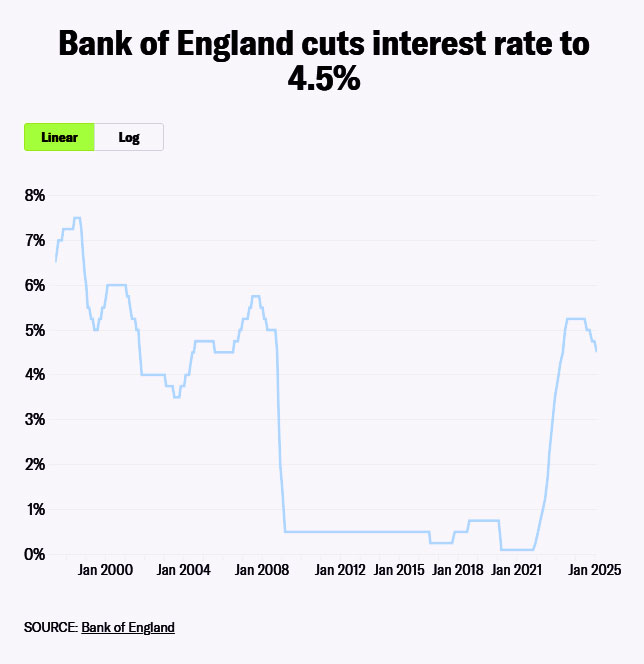

The Bank of England (BoE) is expected to hold interest rates steady at 4.5% this Thursday, as policymakers navigate ongoing global uncertainties and mixed signals from the UK economy. For traders and investors, understanding the potential impact of this decision on market movements is crucial.

Navigating Volatile Markets with Trendsignal

As a leader in trading education and strategies, Trendsignal helps traders make informed decisions during times of uncertainty. With the Bank of England adopting a cautious stance, now is the time to leverage proven trading strategies to manage risk and seize opportunities.

Market Sentiment: Rate Hold Anticipated

According to market data, there is a 95% probability that the BoE will maintain the current rate of 4.5%. This conservative approach reflects concerns over economic contraction, geopolitical uncertainties, and fluctuating inflation rates. Many analysts predict a potential rate cut in May, but for now, the focus remains on stability.

Why the BoE May Hold Rates

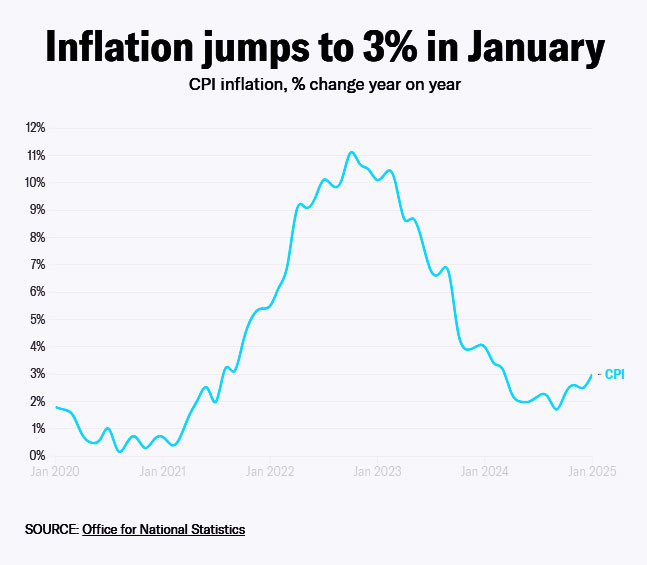

Governor Andrew Bailey has emphasized a “gradual and careful” approach to rate adjustments, considering the lingering effects of US trade tensions and domestic inflation pressures. Although recent data shows inflation hovering at 3%, above the 2% target, the BoE is hesitant to make sudden moves that could destabilize financial markets.

What Does This Mean for Traders?

Holding interest rates can have mixed implications for trading. While stable rates often reduce market volatility, they can also limit opportunities for profit in forex and equities. At Trendsignal, we recommend traders stay prepared for unexpected market reactions by employing strategies that capitalise on price action and market sentiment.

Trading Strategies to Consider:

- Trend Following: Identify long-term trends that may arise from sustained rate holds.

- Range Trading: Exploit the stability of key currency pairs with tight stop losses.

- News-Based Strategies: React promptly to market-moving announcements with pre-defined entry and exit points.

Prepare for Market Reactions with Trendsignal

To navigate these uncertain times, traders should focus on disciplined risk management and precise entry signals. Trendsignal’s tools and expert guidance can help you anticipate market shifts and position your trades accordingly.

Looking Ahead: Rate Cuts on the Horizon?

With forecasts hinting at potential cuts later in the year, traders must stay alert to economic updates and central bank announcements. Any movement from the BoE could create sudden shifts, offering opportunities for those prepared to act.

Stay tuned to Trendsignal for expert insights and real-time trading strategies as the BoE makes its decision this Thursday.