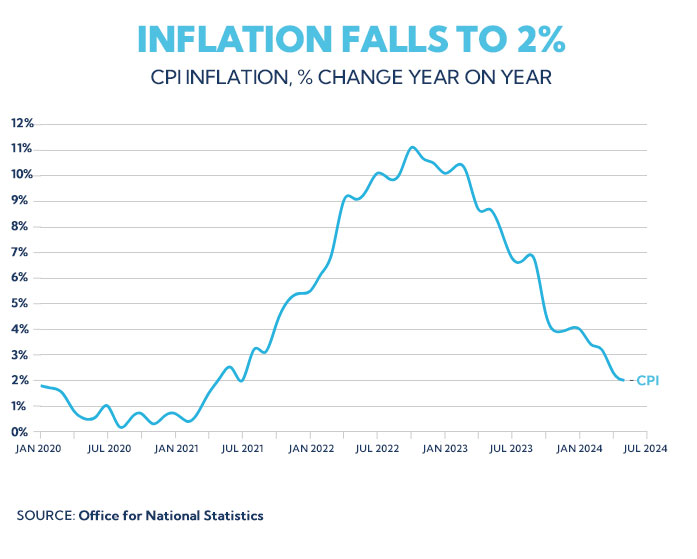

The recent drop in inflation to the Bank of England's (BoE) 2% target, the first time in nearly three years, could signal significant changes ahead for traders. As inflation eases, the likelihood of an interest rate cut this summer increases, impacting various trading strategies.

Key Developments

According to the Office for National Statistics, the Consumer Prices Index (CPI) fell to 2% in May from 2.3% in April. This marks the slowest price rise since July 2021, following a peak of 11.1% in October 2022, the highest since 1981. Core inflation, excluding volatile items like food and energy, also decreased to 3.5% from 3.9%.

Drivers of Inflation Easing

The primary drivers behind this easing were slower price rises in food, soft drinks, recreation, culture, and household goods. Notably, food and soft drink prices rose by 1.7% in the year to May, down from 2.9% in April, reaching the lowest rate since October 2021. Items like bread, cereals, vegetables, and confectionery saw price drops between April and May this year, compared to increases last year.

Bank of England's Response

The BoE's Monetary Policy Committee (MPC) will review these figures on Thursday to decide on interest rates. Although services inflation slightly missed expectations (5.7% versus the expected 5.5%), it reflects underlying economic pressures that could influence the MPC's decision.

Economic Insights

Thomas Pugh, an economist at RSM UK, noted that the lingering impact of the national minimum wage increase might have temporarily boosted services inflation. Despite this, he expects inflation to fall below 2% in June, potentially paving the way for an August rate cut. The Confederation of British Industry (CBI) also supports this outlook, suggesting that the MPC could cautiously cut rates in August, especially if inflation averages just above 2% for the rest of the year.

Implications for Traders

For traders, these developments are crucial. Lower inflation and potential rate cuts could affect currency values, stock market movements, and bond yields. A rate cut typically weakens the pound, making UK exports more competitive but reducing returns on UK-based investments. This scenario might lead traders to adjust their portfolios, favouring sectors that benefit from lower interest rates, such as real estate and consumer goods.

Mortgage Market Impact

Personal finance analyst Alice Haine from Bestinvest highlighted that easing inflation, coupled with wage growth, improves affordability for homebuyers. A potential rate cut could further enhance prospects for buyers and homeowners looking to refinance, although market uncertainty remains.

Conclusion

Traders should closely monitor the BoE's upcoming decisions and economic indicators. Understanding the dynamics of inflation and interest rates can help traders navigate potential market shifts, optimize their strategies, and capitalize on new opportunities.

Stay informed and ready to adapt as these economic changes unfold, shaping the landscape of trading in the coming months.