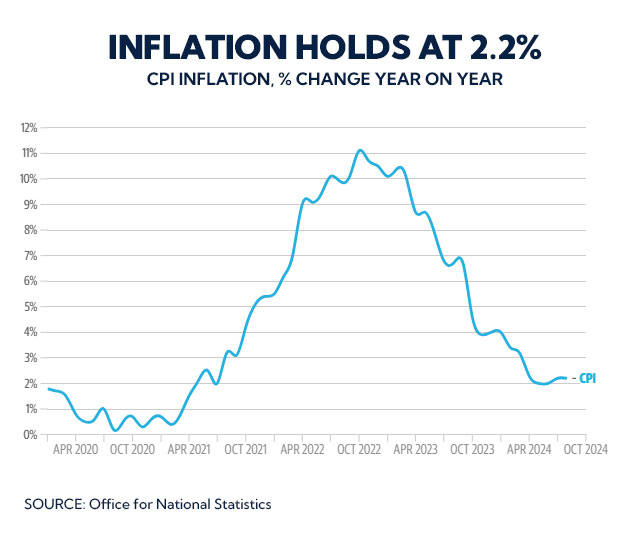

Inflation continues to surpass the Bank of England’s (BoE) 2% target, as official figures for August reveal, keeping the markets and policymakers on edge ahead of the BoE’s upcoming interest rate decision.

The Consumer Prices Index (CPI), a key indicator tracking changes in the cost of living, rose by 2.2% in the 12 months leading to August, according to the Office for National Statistics (ONS). This marks the second consecutive month where inflation remained slightly above the BoE's target.

Core Inflation and Services Inflation on the Rise

Core CPI, which strips out volatile categories like energy, food, alcohol, and tobacco, saw a notable rise, increasing by 3.6% in the year to August, up from 3.3% in July. This exceeded economists' expectations, who had forecast a rise to 3.5%.

Services inflation, closely monitored by the BoE due to its broader economic impact, climbed to 5.6% in August from 5.2% in July. This uptick was influenced by factors such as increased demand during Taylor Swift's UK tour. Higher services inflation has left many wondering how it will weigh on the BoE’s decision-making process.

Interest Rates: No Cut in Sight?

As inflation remains steady, the market is betting on the BoE holding off on any interest rate cuts. According to Yael Selfin, chief economist at KPMG UK, “Strong services sector inflation likely closes the door on an interest rate cut tomorrow.”

Money markets now reflect a slim 14% chance of a rate reduction, down from 25% before the latest inflation data was released. Richard Carter, head of fixed interest research at Quilter Cheviot, added that the rise in core inflation gives the BoE "food for thought," signalling that the central bank is unlikely to change course.

What’s Driving Inflation?

According to the ONS, price movements in air travel and motor fuels played a major role in inflation trends. Airfares surged by 22.2% between July and August, marking the second-highest rise since records began in 2001. This spike was particularly noticeable for European destinations, impacting families during the summer holidays.

In contrast, motor fuel prices offered some relief, falling by 3.4% year-on-year. The average price of petrol decreased by 2.1p per litre between July and August, while diesel prices dropped by 2.6p per litre, easing some of the cost pressures on motorists.

Meanwhile, raw material prices fell, driven by cheaper oil, which helped slow the pace of inflation in factory goods.

Economic Challenges Ahead

Darren Jones, chief secretary to the Treasury, acknowledged that while inflation has become more manageable, its impact over recent years has taken a toll. He emphasized that prices remain much higher than four years ago, highlighting the need for long-term economic recovery.

For homeowners, however, the stability in inflation combined with more competitive mortgage rates could offer a glimmer of hope. Personal finance expert Alice Haine from Bestinvest noted, “For first-time buyers and those looking to remortgage, slightly more competitive mortgage rates mean affordability levels are improving.”

While major lenders have started to reduce mortgage rates, further rate cuts by the BoE could drive competition even higher in the mortgage market. As the BoE’s Monetary Policy Committee (MPC) prepares to make its next decision, homeowners and investors alike are eagerly awaiting the outcome.

Global Implications

As the BoE weighs its decision, other central banks, like the US Federal Reserve, are also in the spotlight. With expectations of a larger-than-anticipated rate cut by the Fed, global markets may soon see more monetary easing, which could further influence the BoE's long-term strategy.

For now, the markets and the public wait for the BoE’s next move, as inflation and interest rates continue to shape the economic landscape.