Last week was a classic example of the risk but also the opportunity that Economic Data releases create.

On 28th April the Bank of Japan announced their latest decision on interest rates. Now, whilst no change was expected, it is often what they say in their statement that carries most sway. However, the thought of deciphering economic jargon to then make a confident trading decision is enough to send shivers down one’s spine.

The good news is you don’t need a complete understanding of macroeconomic theory to trade successfully…

The key for traders is to know that something IS being announced and that it COULD have a big impact on the markets. All we need to know is which announcements have the greatest likelihood of causing movement.

A market continuing in the same direction it was previously travelling isn’t a problem. The problem is that key economic data announcements have the potential to change overall market direction. And there is nothing more important than interest rate decisions and future guidance.

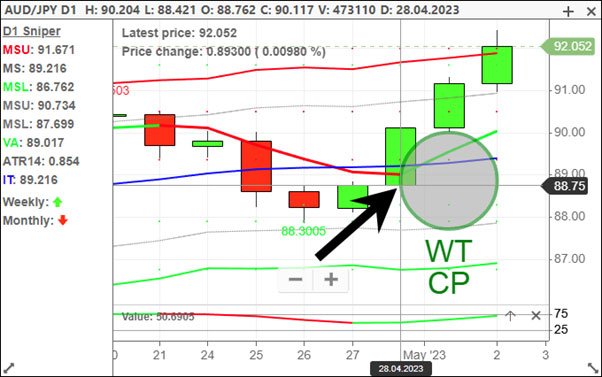

Below is a chart for the AUD/JPY. Being a currency pair that includes the Japanese Yen makes it on that could be greatly affected by any announcement. I have marked (with an arrow) approximately where the price of AUD/JPY was trading as the Bank of Japan made their announcement.

What you then see is a dramatic rally on the back of the announcement. Why? Because the announcement tells us how Japan might conduct their monetary policy over the coming months. That gives new news that traders and investors need to digest and react to. Think of Pension Funds and Hedge Funds repositioning their portfolios and risk – hence the huge moves that can take place AFTER important announcements.

The point is, as a retail trader, in order to better manage risk we should be aware of key economic announcements and manage our risk accordingly.

We don’t need to know what is being said and what that means – we can leave that to those with deeper pockets.

We don’t need to know what is being said and what that means – we can leave that to those with deeper pockets.

Given that the trading strategies we teach on our trading courses only hold trades for a few days, at Trendsignal, we recommend standing aside – closing or reducing risk in related markets. Then, waiting for the reaction and trading the momentum that follows. In the example of last week’s Bank of Japan announcement, related markets would include any currency pairs with JPY in it, and the Nikkei stock index.

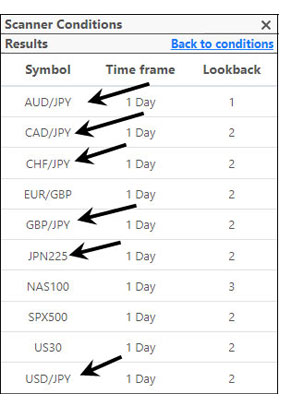

Here you will see the scan results from a few days ago. The Number 2s were triggered the day AFTER the Bank of Japan interest rate announcements – in other words they were trades triggered by the system after the announcement was made. What we can then do is look to trade the momentum that then takes place… looking for price to continue in that direction for a day or 3.

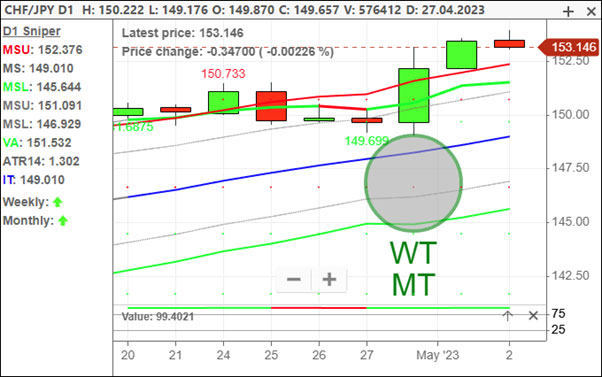

Below are a few screenshots of the trades, and how they have progressed since… each hitting their initial targets within 24 hours.

CAD/JPY - +120 pips rise since buy signal

CHF/JPY - +170 pips rise since buy signal

USD/JPY - +140 pips rise since buy signal

The momentum carried on for a few days giving fantastic opportunity to Trendsignal Plus traders.

Yes, I appreciate the market had already moved quite a bit… but it is essential to know that no-one knew the market was going to rise like this until after it did. Any positions taken ahead of the data announcement is a gamble – and gamblers typically lose money.

What we are looking at here is trading and taking advantage of market momentum. Yes, we might be buying a little higher, but in doing so, history would suggest we are taking advantage of a significantly more likely scenario.

Ultimately, a risk-managed and excellent few day’s trading.

Happy Trading

Adrian Buthee