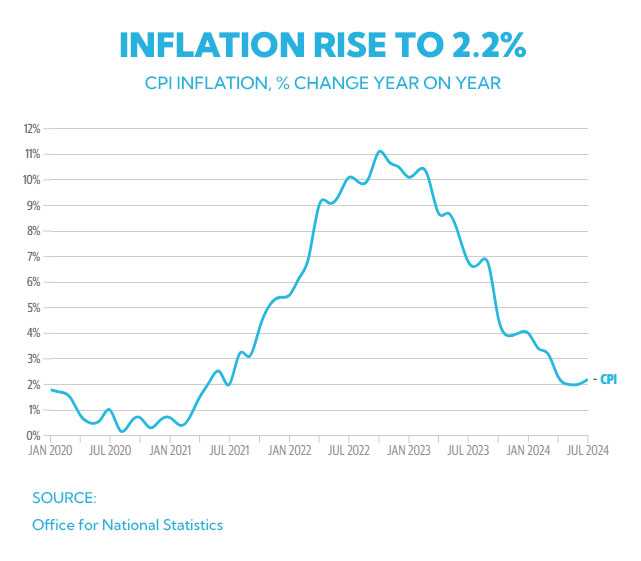

In a development that has caught the attention of traders and investors alike, UK inflation has risen for the first time in over a year, climbing back above the Bank of England's 2% target. According to the latest data from the Office for National Statistics (ONS), the Consumer Prices Index (CPI) increased to 2.2% in July, up from 2% in June. This marks the first rise in CPI since December 2023, following a period of aggressive interest rate hikes aimed at curbing inflation, which had soared to a peak of 11.1% in October 2022.

Key Drivers Behind the Inflation Rise

The latest inflation figures reveal a mixed economic landscape. Core CPI, which excludes volatile food and energy costs, saw a slight decline, falling to 3.3% in July from 3.5% in June. Meanwhile, the CPI services price inflation — a closely watched metric — dropped to 5.2%, its lowest level since June 2022. However, this figure still remains higher than in the eurozone, indicating persistent inflationary pressures in the UK.

The ONS highlighted that the most significant upward pressure on inflation in July came from housing and household services, particularly as gas and electricity prices fell less than they did a year ago. On the other hand, the largest downward contribution to inflation came from the hospitality sector, where hotel prices fell in July, reversing the strong growth seen in June.

Market Implications and Central Bank Response

For traders, these inflationary trends offer crucial insights into the Bank of England's future monetary policy. Despite the uptick in inflation, investment experts caution against overreacting. Steve Matthews, Investment Director at Canada Life Asset Management, noted that wage data continues to decline, and unemployment remains above recent lows. He emphasized that while the inflation rise is noteworthy, it should not deter the Bank of England from considering rate cuts in the near future.

The Bank of England recently cut interest rates from 5.25% to 5%, marking the first reduction after a year of holding them steady. Governor Andrew Bailey has signalled a cautious approach, stressing the need to ensure inflation remains under control before making further rate cuts.

Money markets are now closely watching the Bank's next move, with a 45% chance of another rate cut to 4.75% in September and a 55% chance that rates will remain unchanged.

What Traders Should Watch For

As the inflation landscape evolves, traders should stay alert to the potential implications for the currency markets and interest rate-sensitive sectors. The rise in inflation could influence the Bank of England's decisions in the coming months, with further interest rate adjustments likely to impact trading strategies.

Moreover, the unexpected drop in services inflation, a critical indicator for the Bank of England, suggests that the central bank may need to reassess its inflation outlook. This could lead to increased market volatility, particularly in sectors closely tied to consumer spending and interest rates.

In summary, the recent rise in UK inflation presents both challenges and opportunities for traders. By closely monitoring central bank actions and economic indicators, traders can better navigate the shifting landscape and adjust their strategies accordingly.

Stay tuned to Trendsignal for the latest updates and analysis on market developments and how they impact your trading strategies.